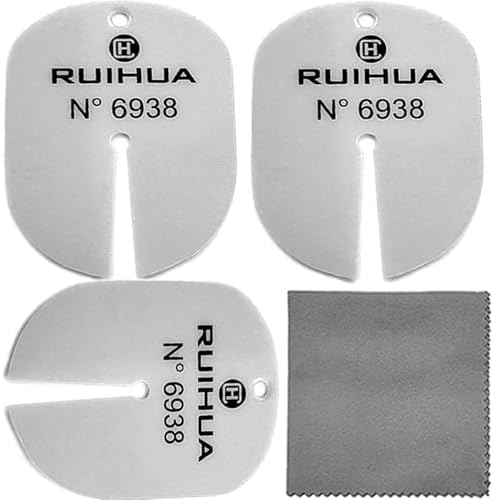

- Just a cover, No include any base, we will try to DIY one base later if possible

- Watchmakers plastic dust cover and tray with compartments. Suitable for watches and pocketwatches. just

- Plastic Dust Cover For Watch Repair. This is an essential tool for watch repair or jewelry repair, after efforts of clea…

7 Best Watch Investments for 2024: A Beginner’s Guide to Value

Are you ready to dive into the incredible world of horology? Finding the best watch investment 2024 has to offer is more than just a financial decision; it’s about owning a piece of history, artistry, and mechanical genius that you can wear on your wrist. It’s an asset that ticks, tells a story, and connects you to a legacy of craftsmanship. This isn’t just about buying a watch; it’s about starting a collection and a passion that can last a lifetime!

Watches are one of the few assets that you can physically enjoy every single day while they potentially appreciate in value. From the iconic silhouette of a Rolex to the intricate movements of a Patek Philippe, the right timepiece is a statement of style and a savvy financial move. We’re here to guide you through the top contenders, explain what makes a watch a solid investment, and get you excited about your first or next big purchase!

What to Know

- Focus on Blue-Chip Brands: For the most reliable value retention and growth, iconic brands like Rolex, Patek Philippe, and Audemars Piguet are the undisputed kings of the watch world.

- Key Value Drivers: A watch’s investment potential is driven by a powerful combination of brand heritage, model scarcity, historical significance, and overall condition. A full set with box and papers is crucial.

- The Pre-Owned Market is Key: While buying new from an authorized dealer is ideal, long waitlists mean the secondary market is where most investment-grade watches are traded, often at a premium over retail.

- Passion First, Profit Second: The golden rule of watch collecting is to buy what you genuinely love to wear. Financial returns are never guaranteed, so your primary return should always be the joy of ownership.

Understanding Watch Investments in 2024: More Than Just Telling Time

So, what exactly turns a luxury timepiece into one of the top watch investments 2024. It’s a fascinating mix of art, science, and economics. Unlike stocks or bonds, a watch is a tangible, alternative asset. You can’t just log into an app and trade it, but you can wear it to a wedding, pass it down to your children, and admire its intricate mechanics up close.

That’s a return on investment you won’t find anywhere else.

The market for luxury watches saw a massive surge in recent years, and while the speculative frenzy has cooled slightly, the foundation for blue-chip models remains incredibly strong. The demand for iconic pieces from top-tier brands still far outstrips supply, creating a landscape where certain watches don’t just hold their value—they often appreciate significantly over time. This is driven by controlled production, timeless design, and a brand reputation built over centuries.

The core benefit of investing in watches is this unique blend of utility and value. You’re acquiring a piece of high-end engineering that serves a purpose and brings daily enjoyment. It can act as a hedge against inflation and a way to diversify your portfolio with a hard asset that isn’t tied directly to the fluctuations of the stock market. It’s a conversation starter, a personal statement, and a potential nest egg all in one.

How to Choose Your First Investment Watch: A Beginner’s Checklist

Jumping into the world of watch collecting can feel overwhelming, but it doesn’t have to be! By focusing on a few core principles, you can make an informed decision and choose a timepiece you’ll love for years to come. These are the foundational watch investment tips 2024 collectors swear by.

Rule #1: Brand is King

In the world of horology, brand reputation is everything. The most stable investments come from brands with a long, uninterrupted history of quality, innovation, and prestige. The “Holy Trinity” of watchmaking—Patek Philippe, Audemars Piguet, and Vacheron Constantin—are at the pinnacle. Just below them, Rolex stands in a class of its own, known for its incredible brand recognition, durability, and value retention.

For a first-time investor, sticking to these established names is the safest bet.

Rule #2: Model & Reference Matter

Not all watches from a top brand are created equal. Within Rolex, for example, a stainless steel professional model like a Submariner or GMT-Master II has far greater investment potential than a more common, two-tone Datejust. You need to research specific models and reference numbers. Iconic designs that have stood the test of time, like the Audemars Piguet Royal Oak or the Omega Speedmaster, are always in high demand.

Rule #3: Condition, Box, and Papers are Crucial

For the best possible resale value, you need what collectors call a “full set.” This includes the original box, warranty card/papers, booklets, and even the hang tags. These items prove the watch’s authenticity and provenance, adding thousands of dollars to its value. The watch’s physical condition is also paramount. While minor scratches from normal wear are acceptable, a watch with an unpolished case and original parts is far more desirable than one that has been heavily restored.

Rule #4: Scarcity and Discontinuation Drive Value

The laws of supply and demand are in full effect here. Watches that are produced in limited numbers or have been discontinued often see the sharpest increase in value. When Rolex discontinued the Submariner Ref. 116610LV (the “Hulk”) in 2020, its price on the secondary market exploded.

Keeping an eye on which models are rumored to be discontinued can be a smart strategy for finding future classics.

Pro Tip: Don’t just follow the hype. Look for “neo-vintage” watches—models from the 1990s and early 2000s. These pieces often have modern reliability with vintage charm and are frequently undervalued compared to their older or newer counterparts. Think five-digit Rolex references or the Omega Speedmaster with tritium dials.

Top 7 Best Watches to Invest in 2024 (Our Expert Picks)

Alright, let’s get to the exciting part! We’ve analyzed the market, listened to the experts, and compiled a list of the absolute best watches to invest in 2024. This list covers everything from the undisputed champion to some incredible value propositions.

1. Rolex Submariner (Ref. 126610LN)

There is no watch more iconic or recognizable than the Rolex Submariner. It’s the original dive watch, a masterpiece of design, and arguably the safest place to put your money in the watch world. The current reference with its ceramic bezel and updated movement is a modern classic that is virtually guaranteed to hold its value. It’s durable, versatile, and respected by everyone.

Pros

- Unmatched Brand Recognition: It’s the most famous luxury watch in the world.

- High Liquidity: You can sell a Submariner easily and quickly anywhere on the globe.

- Robust and Reliable: Built like a tank, it’s a watch you can truly wear every day.

Cons

- Extremely Difficult to Buy at Retail: Expect long waitlists or paying a significant premium on the secondary market.

- Very Common: While it’s an icon, you will see other people wearing one.

2. Audemars Piguet Royal Oak “Jumbo” Extra-Thin (Ref. 16202ST)

Designed by the legendary Gérald Genta in 1972, the Royal Oak created the entire luxury sports watch category. The “Jumbo” is the purest expression of that original design. Its integrated bracelet, octagonal bezel, and incredible finishing make it a piece of wearable art. It’s a top-tier, blue-chip investment for the serious collector.

Pros

- Iconic, Groundbreaking Design: A true piece of watchmaking history.

- Incredible Craftsmanship: The finishing on the case and bracelet is second to none.

- Elite Brand Status: AP is part of the “Holy Trinity” of watch brands.

Cons

- Very High Cost of Entry: This is a significant financial commitment.

- Prone to Scratches: The beautiful brushed and polished surfaces can be scratch magnets.

3. Patek Philippe Nautilus (Ref. 5811/1G)

If the Royal Oak created the category, the Nautilus perfected it. Also a Genta design, the Nautilus is the ultimate grail watch for many collectors. Following the discontinuation of the legendary steel 5711, the new white gold 5811 has taken its place. The demand for any Nautilus is astronomical, making it one of the most sought-after and financially secure investments in all of watchmaking.

Pros

- The Ultimate Grail Watch: Considered by many to be the pinnacle of luxury sports watches.

- Exceptional Movement and Finishing: Patek Philippe’s quality is legendary.

- Massive Demand: Consistently trades for well above its retail price.

Cons

- Essentially Unobtainable at Retail: Reserved for the brand’s most loyal VIP clients.

- Extremely Expensive: Both at retail and on the secondary market.

4. Omega Speedmaster Professional “Moonwatch” (Ref. 310.30.42.50.01.002)

Ready for the best value in Swiss watchmaking. Here it is. The Omega Speedmaster is the first and only watch worn on the moon. That history alone makes it a legend.

The latest version features a superb co-axial movement, a beautifully detailed bracelet, and the same iconic design that NASA astronauts trusted with their lives. It’s a true icon that is both accessible and has strong potential for appreciation.

Pros

- Unbeatable History and Heritage: The Moonwatch story is one of the best in any industry.

- Excellent Value Proposition: You get a legendary chronograph for a fraction of the price of a Rolex Daytona.

- Readily Available: You can typically buy a Speedmaster without a long wait.

Cons

- Manual-Wind Movement: Some prefer the convenience of an automatic watch (though purists love the daily ritual).

- Value Appreciation is Slower: While it holds value well, it doesn’t see the dramatic spikes of a Rolex or Patek.

5. Rolex GMT-Master II “Pepsi” or “Batgirl” (Ref. 126710BLRO/BLNR)

Originally designed for Pan Am pilots, the GMT-Master II is the ultimate traveler’s watch. Its iconic two-tone ceramic bezel allows tracking of multiple time zones and is a stunning piece of engineering. Whether you prefer the classic red and blue “Pepsi” or the modern blue and black “Batgirl,” the demand for these models is off the charts, making them fantastic investments.

Pros

- Highly Useful Complication: The GMT function is perfect for frequent travelers.

- Stunning Aesthetics: The bi-color ceramic bezel is a visual masterpiece.

- Incredible Demand: Like other Rolex steel sports models, it commands a high premium.

Cons

- Virtually Impossible to Buy New: The waitlist at authorized dealers can be many years long.

- Jubilee Bracelet Isn’t for Everyone: Some prefer the sportier look of Rolex’s Oyster bracelet.

6. Cartier Santos de Cartier (Large Model)

Don’t sleep on Cartier. Originally created in 1904 for aviator Alberto Santos-Dumont, the Santos is arguably the first men’s wristwatch ever made. Its classic square case, Roman numerals, and exposed screws make it instantly recognizable. The Santos has seen a massive resurgence in popularity, blending elegance and sportiness perfectly.

It’s a stylish choice with solid investment credentials.

Pros

- Timeless, Historic Design: Own a piece of true watchmaking history.

- Incredibly Versatile: It looks great with a suit or a t-shirt.

- Innovative Bracelet System: The SmartLink and QuickSwitch systems for adjusting and changing straps are brilliant.

Cons

- Polished Bezel is a Scratch Magnet: You’ll need to be mindful of bumps and scrapes.

- Brand is Seen as “Jewelry” by Some Purists: Though this perception is rapidly changing.

7. Vacheron Constantin Overseas (Ref. 4500V)

The Overseas is the dark horse in the luxury sports watch race, and that’s what makes it so cool. Made by the oldest continuously operating watch manufacturer in the world, the quality is simply breathtaking. Its Maltese cross-inspired bezel and integrated bracelet are distinctive, and the quick-change strap system makes it three watches in one. As collectors look for alternatives to the Nautilus and Royal Oak, the Overseas has seen its star rise dramatically.

Pros

- Exceptional Quality from a “Holy Trinity” Brand: The craftsmanship is truly elite.

- Less Common than its Rivals: Offers a degree of exclusivity.

- Fantastic Versatility: Comes with steel, rubber, and leather straps that can be changed in seconds.

Cons

- Brand Recognition is Lower than Rolex/Patek: Only true watch aficionados will know what it is.

- Secondary Market Value is Strong but not as Inflated as AP/Patek: This can also be seen as a pro, as the entry point is more reasonable.

The Smart Alternative: High-Value Microbrands and Accessible Swiss Watches

Let’s be honest: the prices for the watches listed above can be intimidating. But what if you want the thrill of Swiss-made quality, a bold design, and the pride of ownership without needing to take out a second mortgage? This is where the exciting world of microbrands comes in, and it’s one of the best parts of the watch hobby today!

Microbrands are small, independent companies fueled by passion. They often produce watches in limited batches, offering incredible value by selling directly to consumers. You get amazing specifications—like Swiss movements, sapphire crystals, and fantastic build quality—for a fraction of the price of the big luxury names.

For an amazing example, look no further than LIV Swiss Watches. They build tough, aggressive, and unapologetically bold timepieces right in Switzerland. They focus on creating limited-edition collections, which means you’re getting something unique that isn’t mass-produced. While a LIV watch might not be an “investment” in the same way as a Rolex, it’s a massive investment in your enjoyment of the hobby.

It’s the perfect way to experience the quality and soul of Swiss watchmaking and own a conversation piece that stands out from the crowd.

Investment Watch Price Comparison: What to Expect

Navigating the cost of luxury watches requires understanding the difference between the Manufacturer’s Suggested Retail Price (MSRP) and the actual market price on the secondary market. For the most in-demand models, the market price is often significantly higher. Here’s a general idea of what you can expect to pay in 2024.

| Watch Model | Brand | Typical Market Price Range (2024) | Investment Outlook |

|---|---|---|---|

| Submariner (126610LN) | Rolex | $14,000 – $17,000 | Stable, High Liquidity |

| Royal Oak “Jumbo” (16202ST) | Audemars Piguet | $70,000 – $90,000 | Strong, Blue-Chip |

| Speedmaster Pro (Moonwatch) | Omega | $6,000 – $8,000 | Growing, Excellent Value |

| Santos de Cartier (Large) | Cartier | $7,000 – $9,000 | Strong, Trend-Driven |

| Vacheron Constantin Overseas | Vacheron Constantin | $28,000 – $35,000 | Very Strong, Rising |

| LIV GX1 | LIV Swiss Watches | Check current price on Amazon | Hobby/Collector Value |

Disclaimer: These prices are estimates based on the secondary market and can fluctuate based on condition, seller, and market demand. Always do your own research.

The Pros and Cons of Investing in Luxury Watches

Like any investment, putting your money into watches comes with both amazing benefits and potential risks. It’s essential to go in with your eyes open. Here’s a balanced look at the upsides and downsides.

The Upsides (Pros)

- A Tangible Asset You Can Enjoy: This is the biggest advantage! You can wear and enjoy your investment every single day. It’s a piece of art and engineering that serves a real purpose.

- Potential for Strong Returns: The right watch, bought at the right price, can appreciate significantly over time, often outpacing inflation.

- A Passionate Community: Watch collecting connects you with a global community of enthusiasts. It’s a fun hobby with endless learning opportunities.

- A Lasting Legacy: A fine watch is built to last for generations. It’s something you can pass down to your children, carrying stories and memories with it.

The Downsides (Cons)

- Not a Liquid Asset: Unlike stocks, you can’t sell a watch instantly. Finding the right buyer at the right price can take time.

- High Cost of Entry: Getting into the investment-grade market requires significant capital.

- Risk of Theft and Damage: A luxury watch on your wrist can make you a target. Proper insurance is an absolute must.

- Market Volatility: The watch market is subject to trends and can be unpredictable. What’s hot today might not be tomorrow.

- High Maintenance Costs: A mechanical watch needs servicing every 5-10 years, which can cost anywhere from a few hundred to several thousand dollars.

Expert Video: 10 Watches to Invest in for 2024

Want to see some of these amazing timepieces in action? This fantastic video from The Time Teller breaks down some of the top investment picks for the year, offering great insights and visuals.

Frequently Asked Questions (FAQ)

We get a lot of questions about watch investing, so we’ve answered some of the most common ones right here.

What is the best watch to invest in 2024?

For the safest bet with the highest liquidity, the Rolex Submariner (Ref. 126610LN) is widely considered the best overall investment. Its universal appeal, brand strength, and consistent demand make it a blue-chip asset. However, the “best” watch truly depends on your budget and goals.

For a more accessible price point with historical significance, the Omega Speedmaster Professional is an outstanding choice.

What watch will never lose value?

While no investment is ever 100% guaranteed, stainless steel sports models from Rolex come the closest to this ideal. Models like the Submariner, GMT-Master II, and Daytona have such a massive and sustained global demand that they have historically always traded above their retail price on the secondary market. Their value has proven to be remarkably resilient even during economic downturns.

What watches will rise in value?

Watches that are most likely to rise in value typically fall into a few categories. First are discontinued models of popular watches, as supply is suddenly cut off. Second are limited or special editions that were produced in small numbers. Finally, watches from brands with rapidly growing popularity and tightly controlled production, like Vacheron Constantin’s Overseas line, are seeing strong appreciation as more collectors discover them.

Is a luxury watch a good investment?

A luxury watch can be a good investment, but it should be approached as a passion-driven, long-term asset. It’s not a get-rich-quick scheme. The financial returns can be excellent, but they are not guaranteed. The primary return should be the joy you get from owning and wearing a beautiful piece of mechanical art.

If it also happens to increase in value, that’s a fantastic bonus.

Final Thoughts: Is a Watch Investment Right for You?

Embarking on a watch collecting journey is one of the most rewarding hobbies you can have. It’s a deep and fascinating world filled with history, technology, and incredible artistry. Finding the best watch investment 2024 has to offer is about balancing your head and your heart—making a smart choice that also brings you immense personal satisfaction.

Remember the core principles: do your research, buy from reputable sources, and prioritize brands with proven track records like Rolex, Omega, and the Holy Trinity. But most importantly, buy the watch that speaks to you, the one you can’t wait to strap on your wrist every morning. That’s the true measure of a great investment.

If you’re excited to start your journey with a timepiece that delivers incredible Swiss quality and a bold, unique design, take a look at the amazing collections from LIV Swiss Watches. It’s the perfect way to experience the passion of watch collecting and own something truly special.

Leave a Reply